2025 Federal Tax Withholding Tables

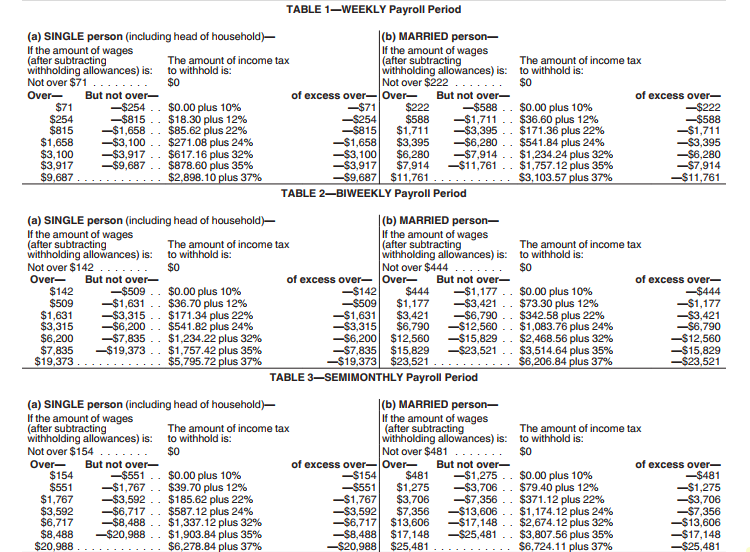

2025 Federal Tax Withholding Tables. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Taxable income and filing status determine which federal tax rates apply.

Virginia, distinct from states like california, has five primary types of payroll taxes that employers must remain cognizant of: The 2025 tables for federal income tax withholding are now available, irs said during a recent payroll industry call.

Publication 15 Tax Withholding Tables Federal Withholding Tables 2025, The federal federal allowance for over 65 years of age single filer in 2025 is $ 1,950.00. Tax rates for the 2025 year of assessment just one lap, here are the federal tax brackets for 2025 vs.

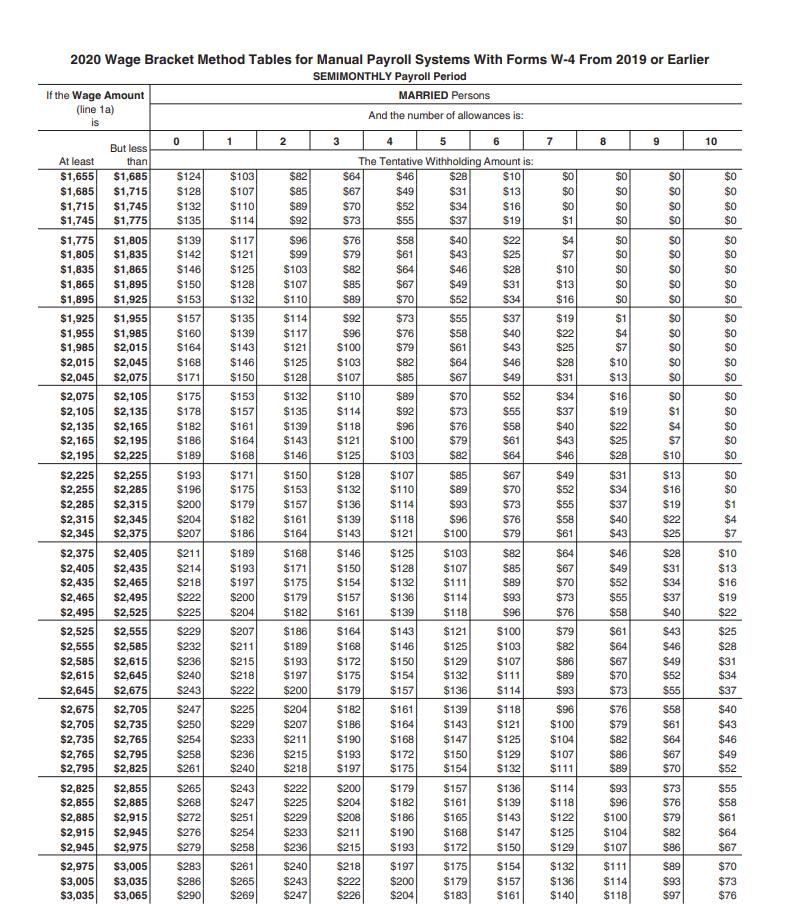

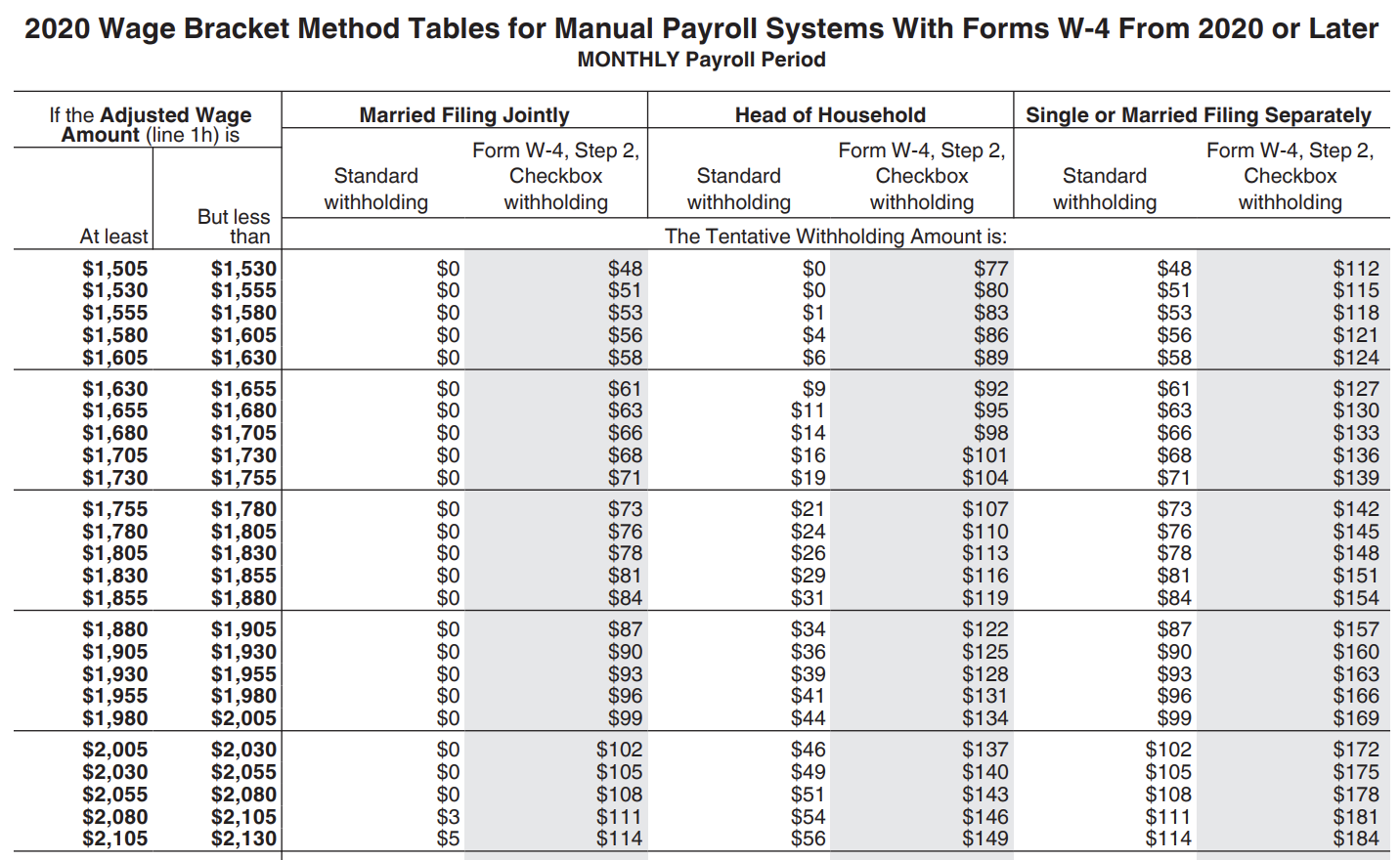

Married Federal Tax Withholding Table Federal Withholding Tables 2025, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. As in 2025, the marginal tax rate (s) of 10%, 12%, 22%, 24%, 32%, 35%, and 37% will be in effect in 2025.

2025 Tax Brackets Calculator Nedi Lorianne, The legislated stage 3 income tax cuts are not due to commence until 1 july. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Federal Withholding Tables 2025, Find tax withholding information for employees, employers and foreign persons. The tables are effective jan.

Fed Employer Withholding Tax Chart Hot Sex Picture, The average income tax rate in 2025 was 14.9 percent. See page 2 for more information on each step, who can claim exemption from withholding, and.

Texas Withholding Tables Federal Withholding Tables 2025, The top marginal income tax rate. In 2025 and 2025, there are seven federal income tax rates and brackets:

Maximize Your Paycheck Understanding FICA Tax in 2025, As in 2025, the marginal tax rate (s) of 10%, 12%, 22%, 24%, 32%, 35%, and 37% will be in effect in 2025. The tax tables for frederick county have changed for single and married filers.

Federal Tax Withholding Tables For Employers Matttroy, Missouri tax withholding tables 2025 federal withholding, the missouri individual income tax rate is being reduced from 4.95% to 4.8% effective january 1, 2025. Publication 15a employer's supplemental tax guide;

IRS Weekly Withholding Tax Table Federal Withholding Tables 2025, Find tax withholding information for employees, employers and foreign persons. Taxable income and filing status determine which federal tax rates apply.

Ms Employee Withholding Form 2025 Printable Forms Free Online, Tax rates for the 2025 year of assessment just one lap, here are the federal tax brackets for 2025 vs. See page 2 for more information on each step, who can claim exemption from withholding, and.